In my last article, I explained the differences between dispatchable and non-dispatchable generation sources. From that article, you likely recall that while both serve important roles in producing the electrical power you and I use over the course of our day, dispatchable resources like natural gas and hydropower play an especially crucial role. Dispatchers can call on a dispatchable resource (hence its name) to increase or decrease production depending on how much or how little production is needed on the grid to match demand. In other words, dispatchable resources are used not only to compensate for the variation in the load you and I place on the grid, but also for the variations in the amount of power being produced by renewable resources like wind and solar throughout the day. In fact, without dispatchable resources, our consumption of electricity would be limited to when renewable resources were producing. Fortunately, that is not the case…at least not today.

Last month, I also mentioned the benefits we in the Pacific Northwest (PNW) enjoy from access to hydropower. In the past, that access was abundant. Recognizing that no new large-scale hydroelectric projects have been constructed in the PNW for many decades, this is no longer the case. About 20 years ago, the Bonneville Power Administration (BPA), which oversees the production of electric power from the federal projects in the Columbia River Basin, forecast this. BPA foresaw that load growth in the PNW would soon surpass the production capacity of the hydro resources it managed. This created a problem.

The power supply contracts between BPA and its customers (like KEC) required BPA to supply their “full requirements.” So, to the extent that their customers’ cumulative load exceeded the output of the federal dams, BPA was required to procure additional power to make up the difference. The problem was that additional power was expected to cost considerably more than the cost of power from the hydro resources. In other words, BPA’s cost of power was forecast to increase because of utilities that were growing. At the same time, those additional costs would be paid by all of BPA’s customers regardless of whether they were growing. It is no surprise that the non-growing utilities objected to this outcome and demanded a change.

To address this concern, BPA developed a new contract (now nearly 20 years old) that allocated a pro-rata share of the output from the federal dams to each of its existing customers. Each utility’s load up to that allocated share would be served at the embedded low cost of the federal hydro system. Load in excess of that share would need to be served by other, non-federal, resources at the prevailing market cost.

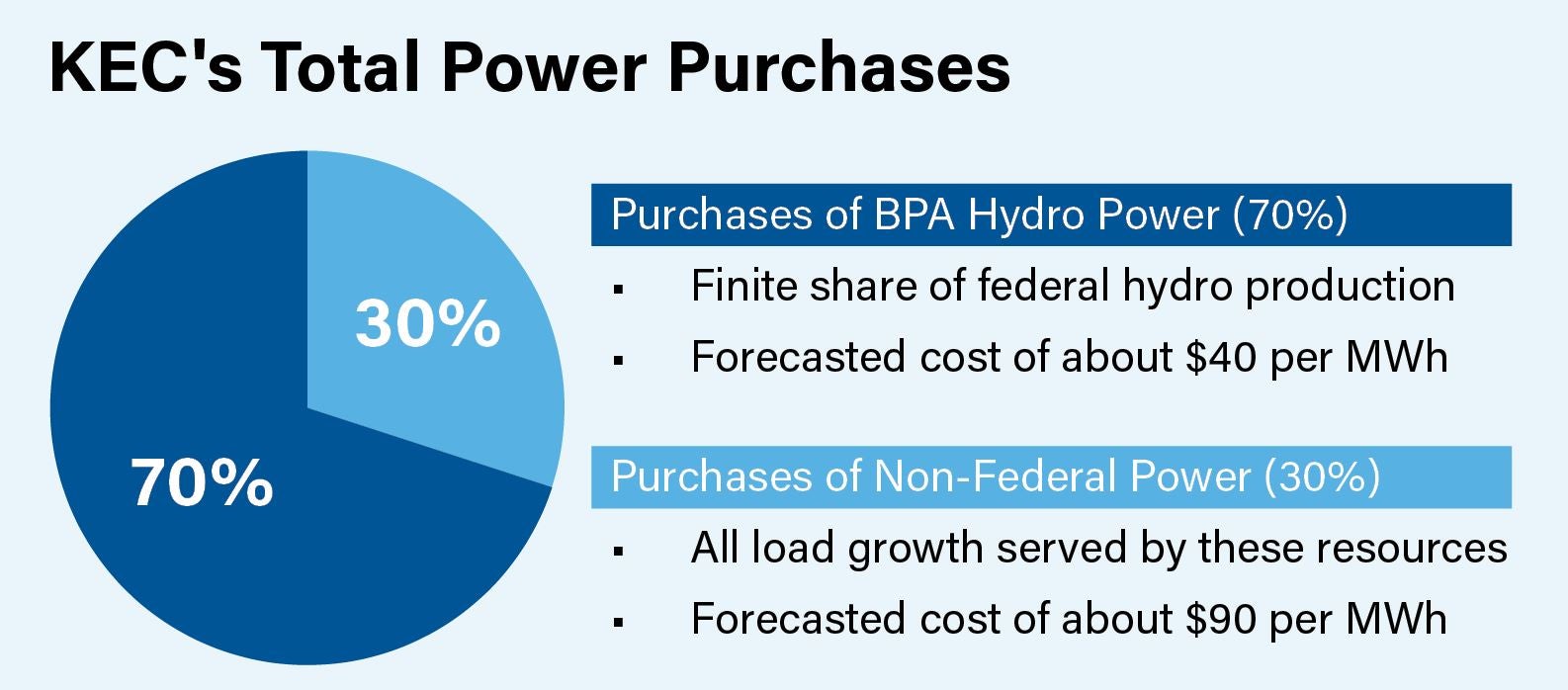

For some context, BPA has about 150 customers of which KEC is one. KEC’s share of the federal hydro resources is about 0.7% of their system’s total firm output, or about 51 average megawatts (aMW). Today, KEC’s total load is around 73 aMW. In other words, approximately 70% of the power KEC sells to its members, like you, comes from the low-cost, dispatchable, renewable, federal hydroelectric power produced in the Columbia River Basin. The other 30% of our power must be purchased from other resources. This "new" contract with BPA, which became effective in 2011, expires in 2027.

For some context, BPA has about 150 customers of which KEC is one. KEC’s share of the federal hydro resources is about 0.7% of their system’s total firm output, or about 51 average megawatts (aMW). Today, KEC’s total load is around 73 aMW. In other words, approximately 70% of the power KEC sells to its members, like you, comes from the low-cost, dispatchable, renewable, federal hydroelectric power produced in the Columbia River Basin. The other 30% of our power must be purchased from other resources. This "new" contract with BPA, which became effective in 2011, expires in 2027.

Interestingly, between 2011 and around 2023, power from non-federal resources was abundant. For this reason, the cost of purchasing it was on par with the cost of hydropower sold by BPA. In many cases, it was actually less! Unfortunately, this is no longer the case. For reasons explained in prior articles, the cost of non-federal power is now about two to two and a half times the cost of power from BPA.

BPA is negotiating a new long-term contract with its customers that, for all practical purposes, looks identical to the current one. Despite its many warts, the new contract will allow KEC continued access to 51 aMW of low-cost hydropower. Absent that, all power (as opposed to only our growth) would need to be served from other resources.

What does this mean for BPA’s customers, like KEC, who have growing load and what is KEC doing about it? Bluntly put, utilities with growing loads will experience increased costs and rate pressure over the next decade until additional power generation resources are built to serve it. By the end of the decade, the cost of procuring 40% of our total power requirements is anticipated to double, though the actual impact this will have on rates is less than you might expect. Growth actually helps mitigate some of those increases. Nonetheless, we will face rate pressures because of this.

While BPA has been our primary power provider for the last 86 years, it will become increasingly irrelevant in the decades to come. For this reason, KEC is actively engaged in evaluating, developing and considering investment in the resources that will be needed to serve our load growth now and well into the future. In doing so, we can best control the costs and reliability of power required by our customers.

To accomplish this, KEC is joining a power supply cooperative comprised of 17 other regional cooperatives with similar needs. Collectively, we can more effectively develop a portfolio of power generation resources necessary to serve our cumulative requirements.

I recognize that the subject of this article may seem scary or perhaps dire. Let me reassure you: while we face a future that looks very different than the past, we are poised and prepared to meet the challenges it throws our way. We have no choice but to forge a new path forward. We have the good fortune of being able to foresee it and to plan for it.